In July of 2018, the Kichwa Nation of Sarayaku came forth with a bold and visionary proposal for protecting their Amazonian homeland and other rainforests across the world.

Their proposal – the Kawsak Sacha (Living Forest) Declaration – was issued by the Amazon Rainforest itself. According to the Sarayaku, it was communicated to their community by the forest through their yachaks (or ‘shamans’), who act as the spiritual intermediaries between the rainforest and its protectors.

As reported by the Ecologist:

Instead of seeing Sarayaku territory as an inert space to exploit for resources, the Declaration describes the rainforest as a living entity with consciousness, constituted by all the beings within it, including those from the animal, vegetable, mineral, spiritual and cosmic worlds.

The Declaration asserts that the territory is subject to legal rights and demands that these rights be upheld. It also declares that the area be free of any type of extractive activity such as oil exploitation, mining, logging and biopiracy.

Across the Kawsak Sacha from Bolivia to Ecuador, the growing recognition of the Rights of Nature is forming a renewed basis for ecosocial governance.

As the Sarayaku community asserts their sovereignty against extractive industries that threaten the Rainforest and their way of life, a growing body of scientific evidence is verifying that Indigenous Land Management is the most effective way to prevent deforestation across the planet.

Hundreds of studies on the effects of Native land reclamation in the Kawsak Sacha have shown that restoring Indigenous Sovereignty over the Amazon has prevented billions of tons of carbon emissions.

Yet, as is so often the case, the reality of climate science threatens those most invested in maintaining the status quo. Unable to deny climate collapse, the fossil fuel industry and their mega-corporate allies have invented their own solution: to claim, in fact, that they deserve “credit” for avoiding deforestation.

From the Living Forest to the Carbon Credit Machine

When the emissions trading industry first took off with the launch of the Kyoto Protocol in 1997, even the staunchest advocates of carbon market solutions to the climate crisis were steadfast in opposing the inclusion of avoided deforestation credits on principle.

Because these credits rest on speculative projections of hypothetical deforestation, they are prone to many forms of accounting tricks and cartographic manipulation, not unlike political gerrymandering. Elias Ayrey, a PhD in forest resources, published a video explainer last year outlining 21 different ways these credits are regularly manipulated.

From 2019-2021, Ayrey was the Head Scientist at the carbon market startup Pachama. A core mission of the company is to provide assurances of carbon credit quality in support of market integrity. Yet after two years of having his scientific research on deeply flawed carbon credits routinely ignored, Ayrey chose to resign as head scientist and became an industry whistleblower instead.

This is hardly the first time climate science has clashed with the interests of big business. Today, avoided deforestation credits are a five-billion-dollar industry. But in the first decade after the launch of the Kyoto Protocol, their issuance was far from guaranteed.

It would take an enormous collaboration of the fossil fuel industry and its affiliates, stewarded by the World Economic Forum, to remake the rules of the carbon market. Participants in this WEF consortium included:

1. The Climate Group (an alliance of politicians and companies like British Petroleum, Goldman Sachs, and Starbucks)

2. The WBCSD (whose co-chair at the time was the CEO of Shell Oil, and today includes numerous oil companies)

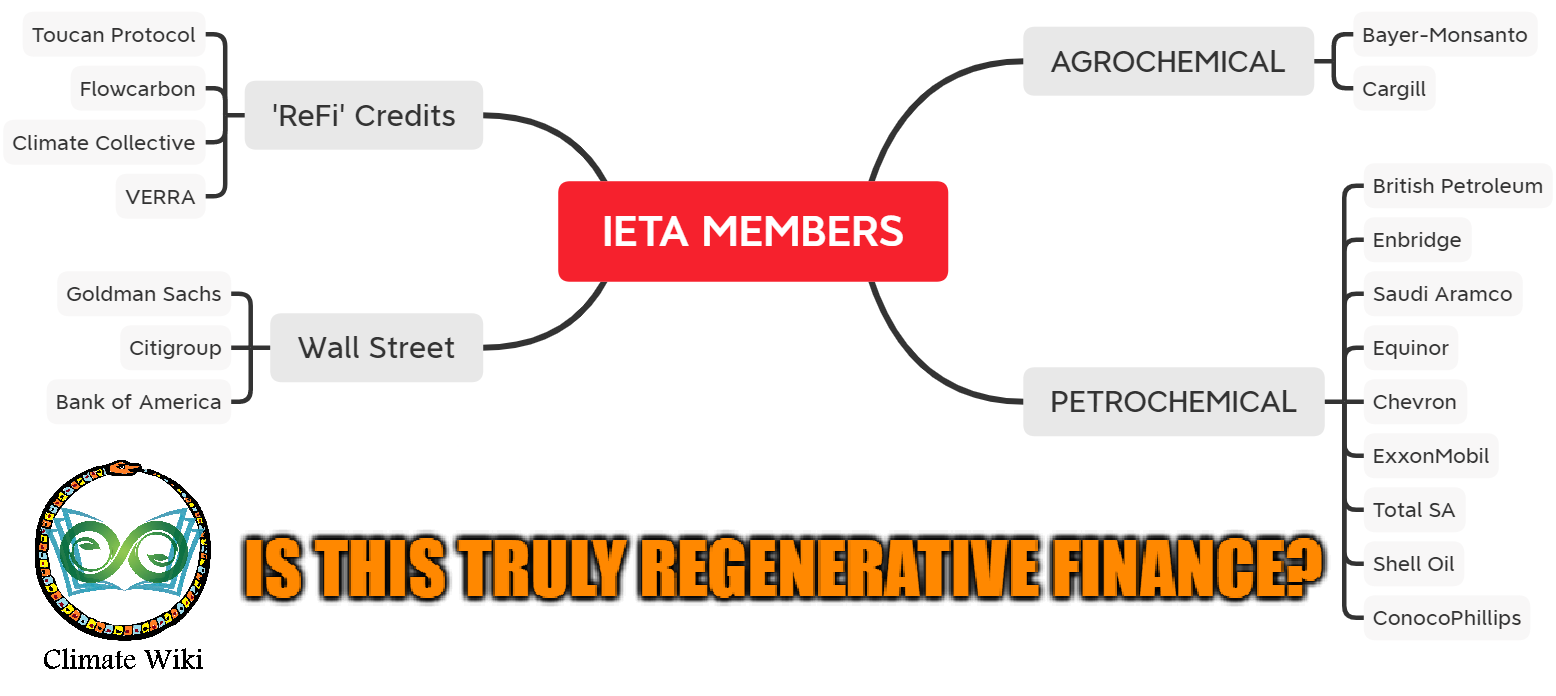

3. The IETA (the largest lobbying group for emissions trading, whose membership includes oil companies like British Petroleum, Chevron, ConocoPhillips, Enbridge, Equinor, ExxonMobil, Saudi Aramco, and Shell Oil; Wall Street giants like Goldman Sachs; and ecocidal ag companies like Bayer-Monsanto and Cargill).

Together, these organizations took over the nascent Verified Carbon Standard in 2006 and launched it through a new non-profit corporation, which they officially founded in 2009 as Verra.

By 2010, Shell Oil was funding the first Verra project issuing avoided deforestation credits, paving the way for the projects and funders to follow. As Verra grew to become the largest registry on the voluntary carbon market, these projects grew to account for 40% of all credits issued by the registry.

Today, the partnership between Shell and Verra is as close as ever. Verra’s expert groups and advisory board include three Shell executives; Verra’s former program director is now a manager at Shell. In turn, Shell remains heavily invested in Verra, purchasing hundreds of millions of dollars worth of carbon credits every year. At the same time, Shell spends $8 billion per year on fossil fuel exploration and extraction.

The Kawsak Sacha and her Protectors have not stood idly by while Shell plays accounting games with the future of our planet. On July 1, 2021, the Kichwa Indigenous Community of Puerto Franco announced that it was taking the Peruvian State to court in defense of its territory claimed by the Cordillera Azul National Park, which has sold the majority of its carbon credits to the European oil companies Total and Shell.

The Kichwa never approved this deal on their sovereign land, let alone the project to begin with. Isidro Sangama, Vice President of the Ethnic Council of the Kichwa Peoples of the Amazon (CEPKA) is calling on the Peruvian State to return the land which was taken from them without consent:

“The State thinks that this territory is in this condition and remains forested due to the care of the National Park, but they forget that in fact this territory has been cared for by Indigenous communities for years.”

CEPKA member Marco Sangama also reported that despite caring for and protecting the forest, the Kichwa community has not benefited from the sale of carbon credits under this project:

The community controls and protects their territory, however they don’t see who is administering the PNCAZ. We understand that this park has benefitted from carbon credits. Despite this, the community has not benefitted, even when they are conserving their lands.

Less than a week after this press release, CIMA (the park manager) publicly hosted a webinar in response to discuss the project along with a law firm, project accreditor Verra, and major oil industry purchaser Total.

Not a single representative of the Kichwa People was invited to participate in the session, prompting an even wider Kichwa federation to issue a joint statement, expressing

deep unease and indignation at the exclusionary and discriminatory vision of the Cordillera Azul National Park in Peru… carried out at the expense of the forests that we have occupied, protected and managed ancestrally, and the violation of our fundamental rights.

And that is how carbon colonialism operates. Through the violation of Indigenous Sovereignty, to cater to the greenwashing bottom-line of corporate polluters, the strange alchemy of carbon accounting is used to transform the Living Forest into a carbon credit machine. As reported by Die Zeit:

The more projects are examined, the clearer it becomes: The rules established by Verra are the problem. If one project bends the rules, all projects bend the rules. Indeed, the rules are not the laws according to which the market works. They themselves are the product. Without the rules, a forest is just a forest. With the rules, a forest becomes a carbon credit machine that makes all those wealthy who sell purported climate protection to large companies so they can claim lower emissions.

Trustless Immutable Credit Laundering

Facing unprecedented scientific critique for the last two months, Verra recently conceded the need to phase rainforest offsets out, although not until 2025.

This decision came in the wake of coordinated reporting by the Guardian, Die Zeit, and Source Material, whose journalists investigated Verra’s rainforest offset schemes and publicized the recent findings of three scientific studies in an accessible form, showing that 94% of these credits are “largely worthless.”

Many of the projects sampled avoided no deforestation at all compared to non-project land. Others over-issued credits by an average of 400%. Such fictitious benefits have allowed Shell Oil, for example, to greenwash its trajectory as “carbon neutral” while making record profits from fossil fuel expansion.

And with the petro-giant pledging in January to invest an additional $450 million in carbon credits, it is only ramping up its commitment to this strategy.

As fossil finance leads the acceleration of corporate demand in the voluntary carbon market today, Verra and its founding fossil-industrial alliances (the WEF, WBCSD, & IETA) are increasingly turning to blockchain technology and cryptocurrency to rebrand Verra’s credits as regenerative finance (ReFi).

Near the end of his omnibus video on forest credit manipulation, whistleblower scientist Elias Ayrey describes how Verra’s crypto partners “take crappy carbon credits, throw them on a blockchain, and don’t tell you which ones are which. They’re recycling them in a money laundering scheme… if you buy a credit on the blockchain, nobody actually knows whether it came from a project that’s crap.”

He gives two examples of crypto startups laundering credits in this way: Flowcarbon and Toucan Protocol. Both of these companies have turned Verra’s forest credits into cryptocurrency, and both are members of the IETA, coordinating jointly with Verra, the WEF, and dozens of the worst corporate polluters.

Flowcarbon is perhaps best known (outside of crypto/climate circles) for its co-founder Adam Neumann, who took off with over $1 billion from the 2019 collapse of his previous startup WeWork, even as the company had to fire 6,000 workers.

Former executives of WeWork describe Neumann as a “cult leader” who exerted centralized control over every aspect of his business. He even went so far as to personally trademark the brand “We” and sell it to WeWork for $5.9 million, until he ultimately returned the money after considerable public outcry.

The “cult leader” has now re-entered the spotlight with Flowcarbon’s upcoming launch of its “Goddess Nature Token” ($GNT), which – as Ayrey describes – pools together a variety of forest carbon offsets in an opaque and haphazard fashion.

Despite hosting an entire initiative on its website named “knowcarbon,” this section provides no knowledge at all about the projects or the carbon which allegedly underlie the $38 million worth of $GNT it has already sold.

But the archive of Flowcarbon’s website shows that among the largest contributors to its pool, one can find hidden within the $GNT such harmful credits as those issued by the Katingan Peatlands Project, which is funded by Shell Oil (the top buyer) and other large polluters such as Delta Airlines, Total Energies, Bentley Motors, Volkswagen, Singapore Airlines, PetroChina International Company, and CNOOC Gas & Power Group.

Since this project began, it has issued credits for land already protected under a governmental moratorium on deforestation, and failed to stop thousands of hectares of ‘protected’ forest from burning up in smoke while additional deforestation has merely leaked out to surrounding areas.

Despite promising to improve community well-being, the project has cut people off from their Indigenous homelands. The majority of villages surveyed in the area reported that changes have been “very negative,” with economic data showing a decline in total household income relative to other villages.

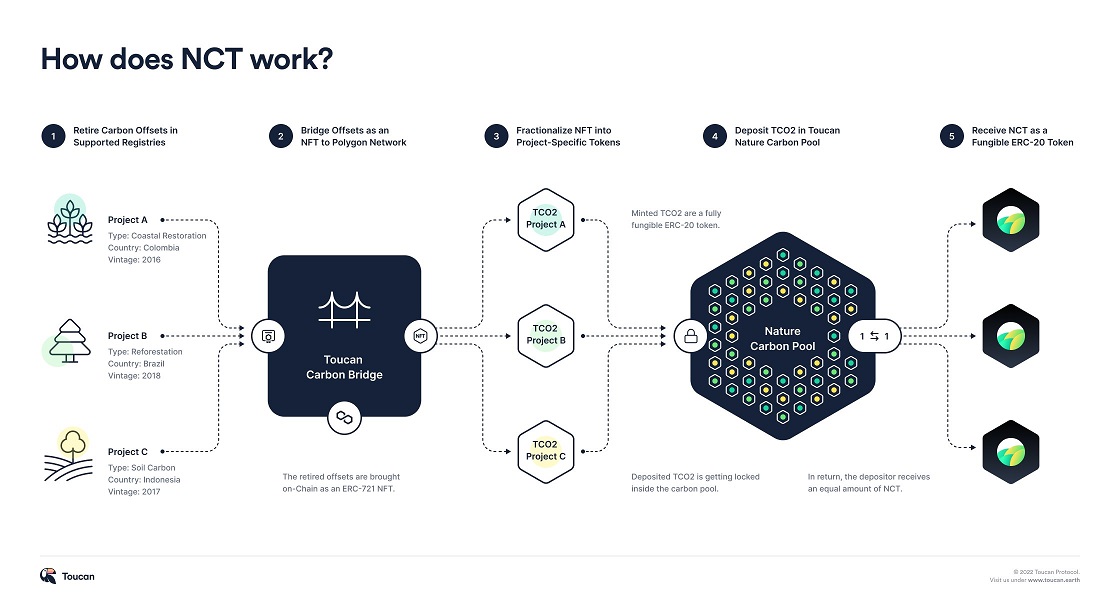

While Flowcarbon has received ReFi’s largest injection of venture capital as it repackages harmful projects such as these, Ayrey describes Toucan Protocol as the worst offender of laundering Verra credits with cryptocurrency so far.

Klima DAO + Toucan Protocol

In terms of sheer credit volume, Ayrey’s measurement is clearly accurate – no other protocol has brought anywhere near as many Verra credits on-chain — meaning onto its crypto blockchain — as Toucan.

With the launch of Toucan’s Base Carbon Ton ($BCT) in Fall 2021, over 20 million carbon credits were turned into crypto tokens in a pool derived entirely from the Verra registry, making up 25% of Verra’s total demand for the year.

The demand for $BCT was driven largely by another crypto token that was launched by KlimaDAO in coordination with Toucan, called $KLIMA. The idea behind $KLIMA was to create a digital, carbon-backed currency by buying all the cheapest Verra credits off the market in what they called “sweeping the floor.”

In April 2022, coordinated reporting from CarbonPlan and Bloomberg described how many of the projects were so low quality even corporate polluters refused to buy them, and they had no market until Toucan and Klima regenerated demand.

The $BCT pool included old Verra credits sold by a fossil gas producer, which issued offsets based on the fallacy of ‘avoiding emissions’ by burning fossil gas instead of coal, despite the former’s greater methane pollution.

Another project manager which received millions in funding via the launch of the $BCT pool was the company behind a Hydropower Dam in India which flooded in 2013, killing thousands of people and displacing thousands more.

In a theory heavily promoted by Toucan and Klima, locking these tokens up in Klima’s treasury would raise the price of carbon credits until corporations were forced to pay more to offset or actually make meaningful emissions reductions.

Instead, the price of $KLIMA fell dramatically. The token is now down over 99.9% from its all-time high. Retail investors who followed KlimaDAO’s promoted model of “cooperative tokenomics” were left holding the bag, but not before billionaire investor and KlimaDAO backer Mark Cuban made off with millions in profits after selling his pre-sale tokens at a massive premium.

In the fallout from the collapse of their “sweeping the floor” strategy, Klima and Toucan split ways and reinvented their respective missions.

Klima, which had purchased the vast majority of $BCT tokenized so far, had no qualms turning around and launching Klima Infinity as an offsetting service, based on the very cheap credits its founding team had only months before argued were being locked up to prevent them from being used for corporate greenwashing.

Polygon, the $10-billion market-cap blockchain on which Klima is based, claimed last year to have become carbon neutral using these offsets.

The Nature Carbon Ton

Toucan, however, was already several months into a new joint venture to rebrand some of Verra’s credits as higher-quality due to their being “nature-based.”

In January 2022, the company stealthily extracted these credits from the $BCT pool, and relaunched them in a new pool called the Nature Carbon Ton ($NCT).

Most of the $NCT pool consisted of the cheapest ‘nature-based’ credits available for purchase on Verra’s registry, due its origins lying in the anonymous “floor-sweeping” executed by $BCT’s biggest original tokenizers (Mark Cuban and a number of anonymous wealthy investors).

And nearly all of them were issued by Verra’s ‘avoided deforestation’ projects.

By the time the latest round of joint reporting publicizing the deep scientific flaws underlying these projects was made known, Toucan Protocol and a new launch partner, Regen Network Development (RND Inc), were already a year into their plan to bridge $NCT to another blockchain network called Cosmos.

In anticipation of $NCT’s second launch on Cosmos, several other blockchains in the network voted to offset their emissions through retiring Toucan’s $NCT credits on-chain once available.

These votes were a part of RND Inc’s Cosmos ZERO initiative, an offsetting project with the goal of helping Cosmos achieve net zero emissions.

RND Inc recommended the Nature Carbon Ton for this function, describing the token as “a premium digital carbon basket of nature-based projects” consisting of “nature-based carbon credits that have verifiable ecological, social, and economic benefits” that were “selected by Regen Network for their premium quality.”

When the methodological flaws of $NCT’s underlying Verra credits were publicized this January, Toucan Protocol’s official response failed to even recognize that its Nature Carbon Ton is based on these methodologies.

Two weeks later, RND’s response partially acknowledged this, but did not provide any evidence of the $NCT’s verifiable ecological, social, or economic benefits.

Instead, RND reiterated its blanket policy that “credits issued by Verra standards can be issued, traded, and retired on the Regen Network blockchain.”

After reassuring its readership – including prospective buyers of Toucan’s $NCT tokens – that only 2/13 projects of the $NCT pool were included in the analyzed sample (Florestal Santa Maria + Pacajai), RND then cited its inability to verify the quality of these projects as a reason to include them:

“because there is no additional data publicly available by which we can further analyze the quality of these projects’ outcome claims, the team at Regen Network feels comfortable proceeding with including these projects in the NCT tokens that will be issued by Toucan protocol on the Regen Network blockchain.”

However, there are three major fallacies with this rationale for approving Toucan’s $NCT:

1) Verification: including projects based on unverifiable data is fundamentally contrary to how RND marketed the $NCT and the Regen Registry’s stated mission of “maintaining the environmental integrity and scientific rigor necessary to ensure projects developed against its credit classes and methodologies are of the highest quality.”

2) Measurement: while the Florestal Santa Maria Project and Pacajai Project are only 2 of 13 contributors to the $NCT pool, together they make up 54% of its total credit volume as the two largest projects tokenized in the basket.

3) Reporting: there is highly relevant publicly available evidence by which to analyze – and reject – both of these projects as well as the NCT Pool as a whole.

$NCT Project #1: Florestal Santa Maria (37%)

The largest issuer in the $NCT pool is Florestal Santa Maria (FSM), a Brazilian project largely funded by fossil transit companies like Delta + GOL Airlines. Supplying 861,000 credits, it composed 37% of the original pool of $NCT tokens.

In the assessment of whistleblower Elias Ayrey, the FSM is no exception to the manipulation which plagues these projects. In his analysis, through ‘leveraging up’ its baseline, the project’s credits are overissued by ~300%. That means even if everything else was sound with the project, 2/3rds of its ‘offsets’ are fictitious.

But this one doesn’t even try to hide its colonialism. As documented by the World Rainforest Movement, the project’s own text describes its chain of custody issuing from acquiring the land from the federal and state government in 1975 as part of an explicit program of colonization. Verra read this document in full, and approved it.

That was during the Brazilian Military dictatorship of 1964-1985, when vast swathes of Amazonian forestland (including the project area) were stolen from Indigenous Nations through a devastating genocide that killed hundreds of thousands of people – as previously reported by Branch Out in 2020.

This violent colonization and privatization of land intensified deforestation in the region, literally paving the way for the threats to the forest that exist today. And in 2017, the original proponent of FSM (Lunardelli), a logging company, had its certification by the Forest Stewardship Council revoked due to:

“violations of labor laws, damage to the forest caused by timber extraction, including logging in areas of permanent preservation – strictly protected by law – and the lack of many management plans and procedures that should be part of its so-called “sustainable forest management.”

In the last few years, FSM’s chain of custody has extended with a new project manager taking over. Although FSC certification has yet to be restored, cryptocurrency is now facilitating the majority of FSM credit purchases.

A prominent marketer of this “fire sale” is Moss, a core methodology developer of the $NCT with RND and Toucan and a close partner of KlimaDAO. Today, multiple former associates of Moss are now directly involved in operating the FSM project.

By its own admission, Moss has “made a lot of money purchasing cheap carbon credits” which it internally recognized as low-quality, only to advertise them as “high-quality” and re-sell them Wolf of Wall Street-style for vastly greater sums.

$NCT Project #2: Pacajai (17%)

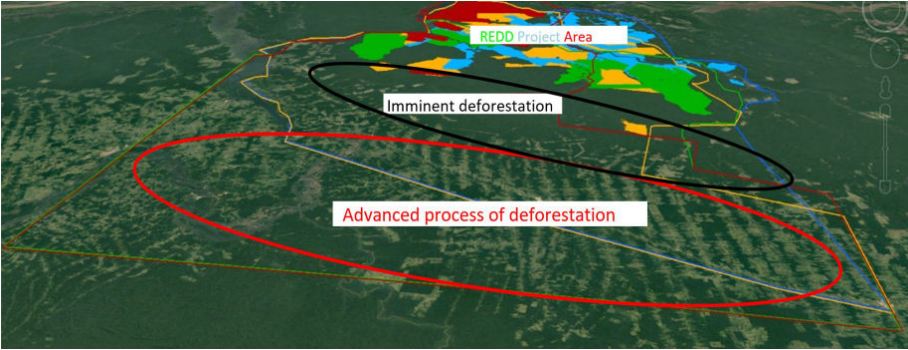

The second largest contributor to the $NCT pool is the Pacajai Project (17%), one of four linked projects in the Xingu region of the Amazon. Rather than being implemented in the neighboring forestland most in need of protection, these projects are located safely away from logging activity.

As in many other Verra projects where projects use deforestation in neighboring areas as a “baseline,” the more deforestation progresses nearby, the more carbon credits the project managers can sell and make a profit from.

And in the project area itself, the managers have set up a massive network of surveillance towers across Xingu Indigenous Land, which they explicitly describe as being operated “to create a big brother atmosphere in the region.”

In the name of avoided deforestation, they are policing Xingu Land Stewards and prohibiting them from practicing cultural burns in the project area, a vital component of their traditional agroforestry method of shifting cultivation.

Shifting cultivation in swiddens prepared via periodic burning is a successful and ecologically regenerative agroforestry system long practiced by Indigenous peoples throughout the region.

Yet like other Indigenous practices of controlled burning throughout the world – which have been shown to reduce wildfire risks by safely consuming dry fuel – it has been demonized as ‘primitive’ and inherently harmful to the environment.

As moisture levels and available land decline due to climate collapse and deforestation, Xingu scientists Yakuna Ullillo Ikpeng and Tariaup Kayabi have helped develop an updated method of Assisted Natural Regeneration.

Along with their co-authors, they propose adapting traditional shifting cultivation and cultural burns to increased fire sensitivity, while emphasizing the production of biochar to “animate the regeneration” and “help the earth to become dark.”

Towards Biocultural Regeneration

Indigenous Peoples across the Kawsak Sacha have cultivated biochar-rich soils for over 9,000 years. As documented in books like Sacred Soils, it was only the devastating genocide and invasion of European colonization which forced the collapse of the Indigenous Biochar Cultures in the Amazon.

Biochar is the only proven method of organically sequestering carbon in soil for thousands of years. Its scientifically recognized status as the negative emissions strategy “at the highest technology readiness level” can turn colonial presumptions about civilization, carbon, and deforestation on their head – when valorized in support of Indigenous Sovereignty.

Far to the west of the Xingu region of the Amazon, the Sachamama Center for Biocultural Regeneration is working to restore the Traditional Ecological Knowledge (TEK) of making rich black soil with biochar amongst the Kichwa people of Lamas.

The importance of their work and leadership is systemically undervalued by a carbon market system designed by Verra and its corporate allies to serve the interests of fossil fuel companies, big corporations, and speculative profit.

All the big money for ‘rainforest conservation’ near the Sachamama Center flows instead to the Shell-funded Cordillera Azul National Park, where the Kichwa people continue to fight for the reparation of their lost income and stolen land. These Verra credits are being resold through Toucan’s Nature Carbon Ton.

Getting companies like Shell Oil to invest ‘regeneratively’ will never establish climate justice after decades of ecocide and denial. Instead, climate finance must prioritize climate reparations – already promised in 2009 by wealthy nations in the amount of $100 billion/year, and yet to be delivered.

With over 90% of excess carbon emissions directly linked to neo-colonial wealth inequality, ensuring that regenerative finance is reparative is not simply a ‘co-benefit.’ Over 400 Indigenous Nations are calling for their land rights to be restored across the Kawsak Sacha, as the planet’s largest jointly governed sanctuary of culture and life. Climate science – rooted in 10,000 years of TEK – shows their management of this land is necessary to avert planetary disaster.

~~~

Full Compendium of Works Cited

~~~

Disclosure: Branch Out received funding from the Regen Network’s community pool process, through which $REGEN token-holders voted 99.71% in favor of our Climate Wiki proposal which included vetting ReFi tokens. This report publicized some of our results ahead of Climate Wiki‘s planned summer launch.

At the time of publication, we held a portion of the $REGEN allocated through this process. After starting a discussion thread on Regen Network’s public forum in a futile attempt to prevent the $NCT from launching prior to addressing the issues identified in this article, we sold the remnant of our $REGEN.

One Reply to “The Living Forest Declaration and the Carbon Market Shell Game”